The wealth of 9 out of every 10 ultra-high-net-worth people (UHNWIs) in India increased in 2022, according to a report by property business Knight Frank.

This is more than double the worldwide average where four in every 10 delighted in wealth growth.According to the Wealth Report 2023 Attitude Survey: India Findings launched on Monday, 35 percent of the UHNWI Indians saw their wealth change by over 10 per cent.

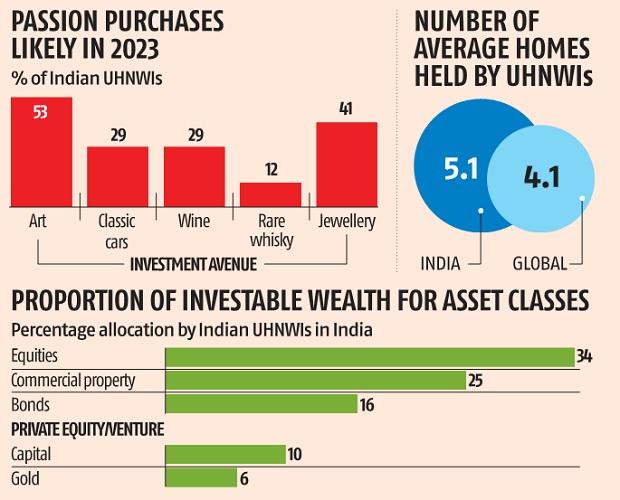

While the extended economic and geopolitical crisis continued to weigh down the majority of the prominent economies, Indias durable financial performance enabled the country to beat international patterns in the year of permacrisis, the report stated.It added that a UHNWI in India owns 5.1 houses, which is greater than the international average of 4.1.

And 37 per cent of the wealth of Indian UHNWIs is assigned to main and secondary houses.

This, too, is higher than the worldwide average of 32 per cent.Likewise, 84 per cent of the investable wealth of Indian UHNWIs is assigned in between equities, realty and bonds.

Amongst these, the equity market became the leading section with 34 percent of their total wealth invested in it.

It was followed by business home (25 percent) and the bond market (16 percent).Internationally, the greatest amount of funds (33 per cent) was assigned to business home.Liam Bailey, worldwide head of research study at Knight Frank, stated that there will be a shift in the investment pattern in the coming year with more concentrate on real estate.

With 69 percent of UHNWIs anticipating to see wealth development in 2023-- we are anticipating a substantial shift in portfolio strategy-- with a look for value opportunities in the real estate sector playing a much bigger function than in recent years, he stated.

Downward pressure on residential or commercial property values, due to higher rates of interest, has actually developed a window for personal capital-- particularly as we enter this brand-new market stage with historic lows in terms of the stock of best-in-class residential or commercial property in property and business markets.

In 2023, 100 percent of the UHNWIs in India and 69 percent worldwide expect their wealth to grow.While 47 percent of those in India expect wealth to increase by more than 10 per cent, 53 percent expect wealth to rise by at least 10 per cent.

The optimism of the ultra-wealthy on wealth generation here is far higher than their international counterparts and this will work as the bedrock of investment and usage decisions, said Shishir Baijal, chairman and managing director, Knight Frank India.

The tumultuous global macro-economic environment and high interest rates will have its impact on market beliefs.

Nevertheless, the new market stage with best-in-class realty in domestic and business sectors is anticipated to witness continued demand, he included.In another report released earlier this month, Knight Frank had actually stated that housing sales in India rose 34 percent to a nine-year high and gross office leasing grew 36 per cent during 2022 throughout 8 major cities in India.

India will have to remain cautious of the international geopolitical and economic obstacles as that can cast a shadow on the pace of development for India, Baijal had actually then cautioned.What UHNWIs desireArt stays the first option as the investment of enthusiasm in India followed by watches and luxury bagsUK most favoured country for home investment; UAE and USA follow18% Indian UHNWIs wish to make an application for a new citizenship in 202319% self-made Indian UHNWIs listed below the age of 40.

International average is 23%

15

15